Free Printable Savings Tracker: Plan The Savings Goals That You Want – Make utilize our cute savings tracker templates so that you may set the financial goals that you’d like to achieve and so that you can keep yourself on track to attaining those savings objectives. This savings tracker provides sufficient area to cover an entire year’s worth of savings goals.

However, you are free to utilize it for whatever period of time best suits your needs. Our printable savings tracker can assist you in achieving your financial objectives, whether those objectives include purchasing a car, going on vacation, or something else.

What Exactly Is A “Free Printable Savings Tracker” And How Can I Get One?

The savings tracker is just a tool that can assist you in keeping tabs on the money that you have put away in the interest of achieving a certain savings goal. You can use a printable template to maintain a count of your savings, and then you can store that template in your calendar or binder.

Many people use their computers to keep a record of whatever savings they put away. In either case, it is helpful to stay focused on the achievement of your savings goal if you keep records of the funds that you have set away.

Why Should You Keep A Savings Record?

Are you find it challenging to put money away? You are aware that this is something you want to pursue, but you do not even plan it out, you don’t give yourself a deadline, and you don’t give yourself a target. Because of this, it is difficult to save money. It is far more difficult to understand what you’re doing as well as where you are headed if the idea of saving is floating around in your head without ever being committed to paper.

The most difficult aspect of saving is forcing oneself to refrain from spending money on indulgences in order to instead put that money in a savings account. When you have a specific purpose in mind as well as a motivation to save money, you are far more likely to put in significantly more work than other people.

It used to be difficult for me to put money away. I mean, I enjoy spending money; I enjoy the feeling of empowerment that comes with purchasing items that bring me joy; yet, I am aware that this feeling is just fleeting and that, in the end, I could have lived without it. Free Printable Savings Tracker

Keeping me away from retail establishments is the quickest and easiest approach to prevent me from frittering away money. If you tend to spend more than you should, the first step in this process should be to look for ways to curb your spending habits. Do not even think about spending that money unless you have given serious consideration to setting some of it aside for savings.

How Can I Stay Track Of The Money I Have Saved?

To begin, you need to determine how you will keep track of your savings:

You’re going to need some method to maintain tabs on the money you put away in savings. Determine the kind of savings tracker which will serve your needs in the most effective manner. This might be a savings tracker that you print out, an app that tracks money, or even just a note that you keep to yourself. Free Printable Savings Tracker

Establish a personal target for your savings:

You need to determine a savings goal for yourself so you’ll have something more to work for when you put money away. This lets you see the eventual result, which is an important step in maintaining your motivation. Free Printable Savings Tracker

Establish a sensible spending plan for each month:

You will be able to determine the amount of money you really have to expend on monthly costs including day items, you will also be able to figure out how much cash you have left over at the end of each month that could be put toward your savings if you create monthly spending that is reasonable. Free Printable Savings Tracker

Set your cash on hand:

It is best to keep your savings separate from the remainder of your money while you are making an effort to save money. This may be kept in a separate savings account, in money envelopes, or at any other secure location. If you put your savings cash in a different fund from the remainder of your cash, you will be significantly less likely to use the funds in your savings account.

Maintain an accurate record in your tracker:

If you put money aside at any point, you need to make sure you maintain track of it. This not only enables you to track how far along you are in the process of reaching your savings goal, but it also enables you to pay for the cash that you are putting away. Utilizing something straightforward like this template is indeed the easiest approach to maintaining tabs on your financial progress in the form of saves.

Instructions For Using The Savings Tracker

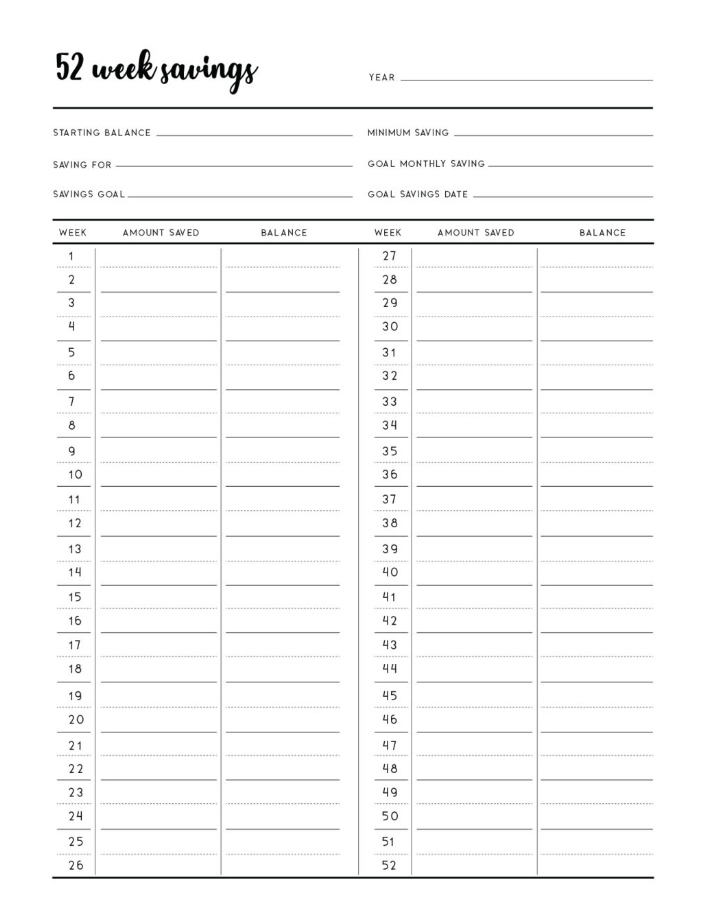

Before you get started with this saving planner, there are numerous things you need to keep in mind before you do anything else. What is the beginning balance for your account right now? Are you beginning with a blank slate, $0? And are you beginning with money you already possess and adding to those funds? You should also write out the purpose of your savings as well as your target savings amount. If you know the end goal of your efforts, it will be much simpler to work toward achieving it.

You need to make it a goal to put away at least some money every week, even if it’s only the bare minimum. If you’re working with a limited budget, you shouldn’t aim too high for this standard, since you won’t be able to sustain the forward motion otherwise. Why not begin with ten dollars? Make it a goal to put away a certain amount of money every month as a starting point. Because it covers a period of 52 weeks, this savings tracker also allows you to include milestones for each individual month.

How much money do you hope to put away every single month? If you want to save $10 per week, then a monthly goal of $40 is a reasonable target for you to shoot towards. You can also use this as a nice approach to determine how much you’d save over the course of a year using your saving base as the only factor. A starting point of $480 is achieved by multiplying $40 by 12!

That’s a wonderful beginning, and there may be some weeks in which you contribute a bit more, despite that, you should make every effort to maintain the minimal amount you save every week. The chart that you use to keep tabs on your progress in saving money has a column for each week, numbered 1 through 52. At the conclusion of every week, you should attempt to write down how much money you saved during that week also what your overall entire amount will be at the conclusion of that week.

If you do this, instead of figuring out the amount at the end of the process, you will be able to see how much money you have earned as you move along. Our 52-Week Saving Monitor is one of my favorites since it is practical and simple, and makes it possible for me to save money without putting undue stress on myself. Free Printable Savings Tracker

Don’t put off beginning your savings! Having a goal to work toward offers you control over your finances, a source of inspiration, and an amazing reward at the finish line. If there is something that you want, you should get a job to earn it, save money for it, and not sit around and hope that it would appear out of thin air. If you start putting money away now, you will be one stepping closer to completing your objective in the future.